FBR IRIS: Being a Pakistani Citizen I am very happy with all the decision taken by the Government of the Punjab. These Decisions are under Information Technology Shelter to avail the hundreds and thousands of benefits from latest technology.

With reference to the title today, I am with you to discuss about some of the very facilitation E-Services. These Services are launched by the Federal Board of Revenue (FBR) to simplify the income and sale tax return.

First of all i am going to share some lines from Wikipedia. The free encyclopedia, is saying about FBR. How it is describing, this is just to clear our concept about the department and its services.

The Federal Board of Revenue (FBR).

The Federal Board of Revenue (FBR) (Urdu: وفاقیہیئتبرائےمحصولات), formerly known as Central Board of Revenue (CBR), is a federal law enforcement agency of Pakistan that investigates tax crimes, suspicious accumulation of wealth and money-laundering. FBR operates through tax inspectors that keep tax evaders under surveillance and perform special tasks for FBR Headquarters. FBR performs role of collection of taxation in the country from all individuals and businesses.

FBR also collects intelligence on tax evasion and administers tax laws for the Government of Pakistan and acts as the central revenue collection agency of Pakistan.

From Wikipedia, the free encyclopedia

As per above quoted information it is very easy to understand that what FBR Department is actually for. To make Pakistan financially strong it is our responsibility to support over Government Departments specially the Income Tax Return Department.

Further, During the period of PTI government, number of positive discussion are implemented to facilitate business persons. Companies and even every individual of Pakistan specially Salaried Persons, Government Employees. These initiatives will help out to file income tax returns , Sale Tax Return and E-Payments in more easily than past.

Now, it is very easy for citizen of Pakistan to is filler even he or she did not paying any tax due to under limit income. Let me discuss some useful FBR Online Services you should know about.

Table of Contents

3 Very Useful FBR Pakistan Online Services you should know about.

If you have no experience before with FBR Online Service you should read this because these service are very important for us as a Pakistan so we will be able to support our Government.

With these FBR Online services it is even very much easy to Return Income Tax Fillings, Refund Applications, Withholding Statement CPR Corrections, GST, Income Tax Payments, Sales Tax Payments. Let me explain these services in short and summarized way.

FBR IRIS LOGIN | Service for Employees & Business Holders.

With reference to the income tax ordinance 2001 all the incomes are divided in further different heads like Salary, Income from Property, Capital Gains etc.

If you are generating revenue from these heads you have to calculate your total yearly income (From July to June of every Financial Year) reduced by the qualifying deductions.

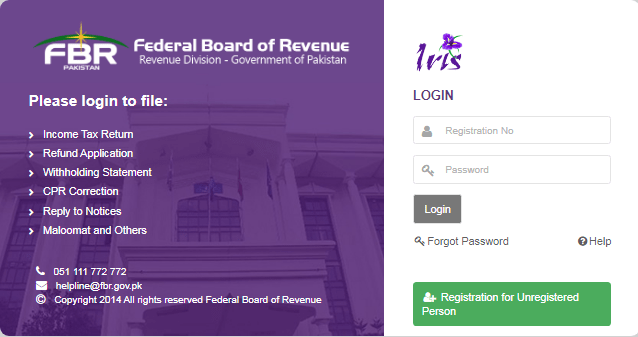

Iris Portal is for every individual so he or she will be able to file Yearly FBR Income Tax Returns. There are some basic steps to register and to submit income tax return from your home with no expense.

Registration for income tax with FBR IRIS Portal.

A person need to file income tax return will have to register with FBR IRIS Portal. For registration, FBR IRIS Portal Need some basic information like Valid CNIC Number, Valid and Registered Mobile Number (Registered in the name of user, Do not Enter Converted Number) and Valid Email Address.

Moreover, After submitting the registration form user will get a text message on registered mobile number and also an email on given Email Address having login credentials. Now user is ready to login in to the FBR IRIS Portal to avail further following service.

- Income Tax Return.

- Refund Application.

- Withholding Statement.

- CPR Correction.

- Reply to Notices.

With latest mobile friendly GUI users will experience more simple and to the point fields for filling income tax return with attractive icon which will lead users toward return. There is also classic view is still available for desktop users with more extra and detailed filings.

E-Filling Portal | for filing Sales Tax Return and FED Return.

According to FBR help desk Importers, Wholesalers, dealers, retailers etc. are required to register through e-filling FBR Portal. The users will be able to file the sales tax return as per schedule under specific financial year.

E-Filling Portal of FBR is internally connected with FBR IRIS Portal so for sale tax registration income tax registration is must.

Registration for sales tax return | E-Filling portal.

For Sale Tax Return registration will be done through FBR IRIS Portal because the registration is internally connected with Income tax FBR IRIS Portal. Electronic Application Form available in Income Tax Return FBR IRIS Login Account.

So, if someone needs registration for Sale Tax Return he or she should first register his or her self as Income Tax Returner. To proceed with Sale tax registration Form 14(1) fill the form with required information and submit it for registration.

ELECTRONIC FILING OF SALES TAX RETURN | E-Filling FBR.

After finalization of Sale Tax Registration Form and its approval FBR Provides E-Filling Portal for registered users so they are able to login their accounts and allowed to create Declarations, E-Payments like Sale Tax Payment PSIDs, GST Income Tax E-Payments, Federal Excise Duty etc.

E-Filling also provides Gust User Account to make E-Payments for Sale Tax Payments, GST Payments and other relevant payments. This guest account helps to create PSIDs on behalf of register farms.

Hope this article stands informative at very basic level. Stay blessed and stay tuned. Thanks

E-SyedHassan