By reading this article you will learn how to fill the 32a challan form and you will also be able to download the 32a Challan form in Pdf, the 32a Challan form in Word, and also in excel formates.

Treasury Challan Form for National Bank or 32-A CHALLAN FORM is used to credit the specified amount from Government Office or by the Private Organizations on behalf of citizens of Pakistan. The cash amount that will be submitted to the account is the Government Treasury account.

The 32-A Challan form is used to pay to the Government of the Punjab Pakistan under different Head of accounts for Stamp Papers, Stamp Duties. 32a challan form is formally known as “Treasury Challan form State Bank of Pakistan” sometimes called as 32-A E-Challan.

By reading this article you will be able to Download the 32A Challan form in PDF Word and Excel free online. This article will also help you to know how to fill the 32a challan form and submit it for the treasury account of the government of Punjab in the National Bank of Pakistan or State Bank of Pakistan. You will also come to know more about Challan Form No. 32A so keep reading.

Table of Contents

Have you ever Filled 32A Challan form?

Let me help you with it so the question is that how to fill 32-A Challan form for government treasury National Bank of Pakistan or State Bank of Pakistan for credit the specified amount regarding Stamp Duty or Government Fees with the help of a simple description about all the columns of 32-A challan form.

How to fill 32A Challan Form (Column by Column)?

There are 2 major parts of this Challan form to be filled by the person from the relevant department or organization. Each Section contains further 3 columns to get more details and particulars.

1ST PART OF 32A CHALLAN: TO BE FILLED IN BY REMITTER.

The Remitter is a person who is going to submit the specified amount to the Government Treasury under the specific head of the account. there are further 3 columns under this section to be filled by the Remitters.

1- By Whom Tendered:

The Name of the Person who needs to submit the specified amount to the Government Treasury. If you are going to submit some amount for your job test then you have to write your name in this column.

2- Name or Designation and Address of the Person on whom Behalf Money is Paid:

In this column, you have to write the Name or the Designation along with the Address of the Officer and the office that asks you to submit the amount.

If you are going to apply for the teaching job in the school education department Punjab then and you have to submit the fee of NTS test for the job then you will write the name of Secretary Education or the Officer of the Department who published the Advertisement of the said job

2nd PART OF 32A CHALLAN FORM: TO BE FILLED IN BY THE DEPARTMENTAL OFFICE OR THE TREASURY.

An official from the Department or private organization providing services on the behalf of the government can define the Amount for remitters under rule and law and fill in this section for emitters.

1-Amount RS.

To purchase the legal articles for example E-Stamp Papers, or to pay the Government Fees a specified amount in RS. If a person is going to apply for the latest Teaching Jobs in Punjab through NTS the fee for NTS Test might be 600/- or 500/- or might be 300/- Rs will be written in this column.

2- Head of the Account in 32A Challan Government of the Punjab.

The most important column in this 32a challan is the Head of the Account. Head of the Account is the account number to which the amount will be credited after the bank process.

The Head of the Account should be provided by the relevant department which is going to claim the amount against the services or the articles issued to the person. As per the previous example, you will get the Head of Account on the job Advertisement if that did not provide 32a challan filled online. In case if the 32a challan is filled online then the Head of Account must already be mentioned in this column.

3-Order to the Bank.

By filling this column the department is describing the responsibilities of the bank in which the 32a challan form is going to be submitted. Normally formal directions will be written to the teller he or she will clearly identify the head of the account in the banking system so the payment can be deposited in the true head.

It is also the responsibility of the Bank Teller that he or she will stamp the 32a challan form and a duplicate copy should be returned to the person who came with the 32a challan for submission.

Download 32a Challan Form (in PDF | in WORD | in EXCLE)

Treasury Challan forms for Government Payments related to the Stamp Duty, Official Recoveries, Payments of Gain Tax, and Payments for Mail Tickets “Daak Tickets”, Vehicle Registration Fees, Property Tax and many other Government Payments to proceed further into the Government Matters.

- 32A-Challan form PDF Download.

- Challan form 32-A in WORD Formate.

- 32-A-Challan form in EXCEL.

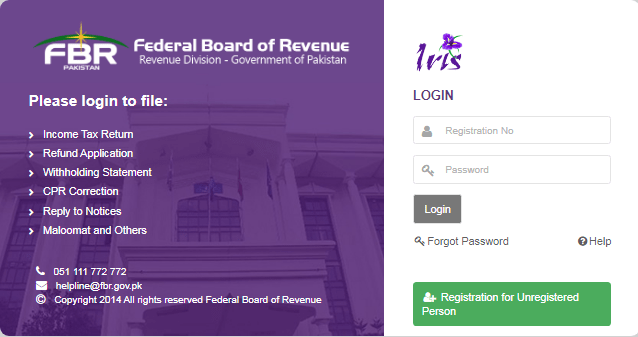

E STAMP PUNJAB CHALLAN 32A

At the end of this article, we must appreciate the Government of Punjab and the Ministry of Information Technology who is trying to provide E-Service with the help of PITB (Punjab Information Technology Board) such as:-

Sedhr Punjab Gov Pk – Punjab Portal for Online Retirement of Public School Teachers and also for PERs C-Leave of Public School Teacher in Punjab.

PEPRIS Online Registration of Private Schools in Punjab, E-Stamp Citizen Portal.

SIS Application for Public School Teachers and also for Private School Teachers to avail E-Transfer and information about Vacant position for Public School Teachers Transfer in Punjab.

There are a number of other Android applications and online portals to facilitate the citizen of Pakistan with the help of the latest technology of Information and sciences. Hope so this article will help you a lot and take your attention to other related articles on E-SyedHassan.online.

Stay Blessed and Stay Safe.